Imagine having a personal financial assistant in your pocket—one that alerts you when there’s a change in your credit score, provides tips for improvement, and even helps you dispute errors. That’s exactly what credit score apps do. They serve as a window into your financial world, offering real-time updates and personalized advice. Whether you’re a seasoned credit user or just starting out, these apps are designed to help you take control of your financial destiny.

In this article, we’ll take an in-depth look at the top 10 credit score apps available today. We’ll cover everything from features and benefits to pros and cons, ensuring you have all the information you need to choose the right app for your unique needs. As you read on, ask yourself: Do I really know where I stand financially? With these tools at your fingertips, you’ll be empowered to make smarter, more confident decisions about your money.

Beyond the convenience of monitoring your credit score, these apps often come packed with extra features such as budgeting tools, credit simulators, and personalized tips to boost your financial health. They’re built with user-friendly interfaces and robust security measures, so you can rest assured that your personal data is safe. Whether you’re aiming to secure a mortgage, apply for a new credit card, or simply want to understand your financial standing better, the right credit score app can be a game changer.

So, let’s dive into our top picks and see how each app can serve as your trusted partner on the journey toward financial wellness.

Table of Contents

Why Monitoring Your Credit Score is Essential

Your credit score quantitatively captures your creditworthiness. It affects almost every aspect of your financial life, including loan and credit card approval possibilities as well as interest rates you are offered. This explains the need of keeping an eye on your credit score:

- Financial Opportunities: A higher credit score can translate into lower interest rates and better loan terms, saving you money in the long run.

- Risk Management: Regular monitoring helps you spot errors or fraudulent activities early on, giving you a chance to correct them before they cause serious damage.

- Informed Decision-Making: When you’re aware of your credit standing, you’re better equipped to make strategic financial decisions, whether it’s taking out a loan or applying for a new credit card.

- Personal Empowerment: Knowledge is power. By understanding your credit score and the factors that influence it, you can take proactive steps to improve your financial health.

In essence, credit score apps serve as your personal financial watchdog, continuously scanning your credit report and alerting you to any significant changes. This proactive approach not only helps you maintain a good credit score but also equips you with the information needed to improve it over time.

Top 10 Credit Score Apps

Below is an in-depth look at the 10 best credit score apps that are designed to help you monitor and manage your financial health. Each app offers a unique set of features tailored to different needs, so you can choose the one that best fits your lifestyle.

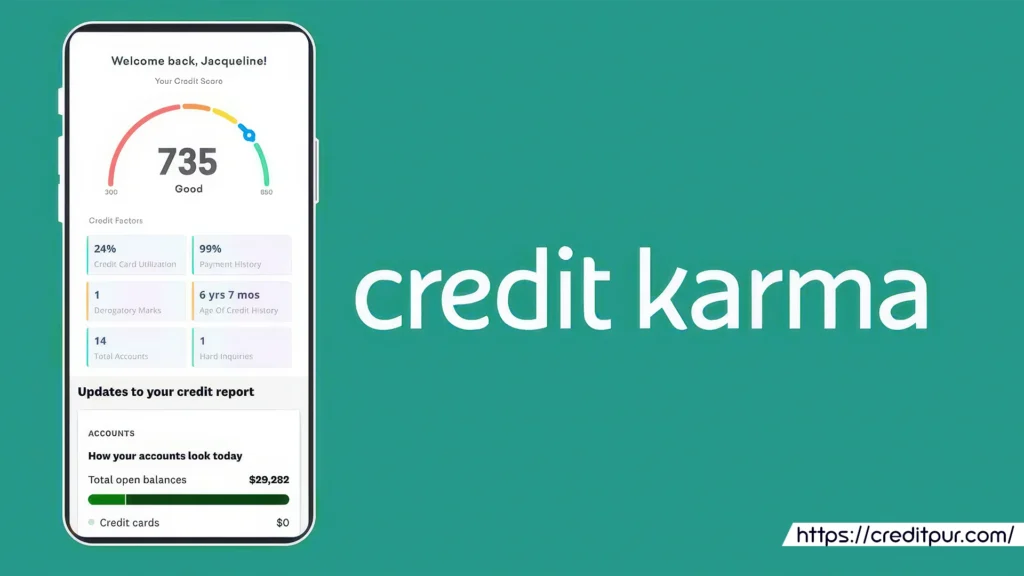

1. Credit Karma

Overview:

Credit Karma is one of the most popular credit score apps on the market, and for good reason. It provides free access to your credit score and detailed credit reports from major bureaus. With a user-friendly interface and personalized financial recommendations, Credit Karma is a go-to choice for millions of users.

Key Features:

- Free Credit Scores: Get your updated credit scores from TransUnion and Equifax without any hidden fees.

- Credit Monitoring: Receive alerts about important changes in your credit report.

- Personalized Recommendations: Tailored advice on credit cards, loans, and other financial products.

- Educational Resources: A wealth of articles and tips to help you understand and improve your credit.

- User-Friendly Dashboard: Easy-to-navigate interface that simplifies complex credit information.

Pros:

- Completely free with no hidden charges.

- Regular updates and proactive alerts.

- Extensive educational content to help improve your credit literacy.

Cons:

- Limited to the credit bureaus it partners with.

- Some users may find occasional ads for financial products distracting.

Who Should Use It?

Credit Karma is ideal for individuals who want free, real-time access to their credit scores along with personalized financial advice. Whether you’re just starting out or have a well-established credit history, Credit Karma’s intuitive design makes managing your credit easy and accessible.

Learn More:

Visit Credit Karma Official Website

2. Mint

Overview:

Mint is more than just a credit score app; it’s a comprehensive personal finance tool. Alongside providing your credit score, Mint offers budgeting tools, expense tracking, and bill reminders—all in one place. This app is perfect for those who want to get a complete picture of their financial health.

Key Features:

- Credit Score Monitoring: Access your free credit score and receive regular updates.

- Budgeting Tools: Create budgets and track your spending across various categories.

- Bill Tracking: Get reminders for impending invoices to prevent late payments.

- Investment Tracking: Monitor your investments and net worth in real time.

- Personalized Insights: Offers tailored advice based on your spending habits and credit behavior.

Pros:

- All-in-one financial management solution.

- Free access to credit score and budgeting tools.

- Simple and visually appealing interface.

Cons:

- Ads and promotional content may be present.

- Some advanced features require linking multiple financial accounts, which may raise privacy concerns for some users.

Who Should Use It?

Mint is best suited for those who want a holistic approach to financial management. If you’re looking for a single app that helps you monitor your credit score while also managing your budget and tracking your expenses, Mint is the perfect choice.

Learn More:

Visit Mint Official Website

3. Experian

Overview:

Experian’s mobile app offers direct access to your Experian credit report and score. With a focus on transparency and accuracy, this app allows you to monitor your credit report and receive alerts about any significant changes. It’s particularly useful for those who want to keep a vigilant eye on their Experian data.

Key Features:

- Experian Credit Score: Free access to your Experian credit score.

- Credit Report Monitoring: Detailed insights into your credit history and report.

- Fraud Protection: Alerts you to any suspicious activities or changes in your credit report.

- Score Simulator: Understand how potential financial decisions might impact your credit score.

- Easy Dispute Process: Simplified tools for disputing inaccuracies directly from the app.

Pros:

- Direct access to Experian’s trusted credit data.

- Comprehensive fraud monitoring and alerts.

- Interactive tools like the score simulator for proactive credit management.

Cons:

- Limited to Experian data; for a complete picture, you might need to use additional services.

- Some features might require a premium subscription.

Who Should Use It?

If you prefer to have a detailed look at your Experian credit data, this app is the ideal choice. It’s especially beneficial for individuals who want to take advantage of fraud protection and need a reliable tool for disputing errors on their report.

Learn More:

Visit Experian Official Website

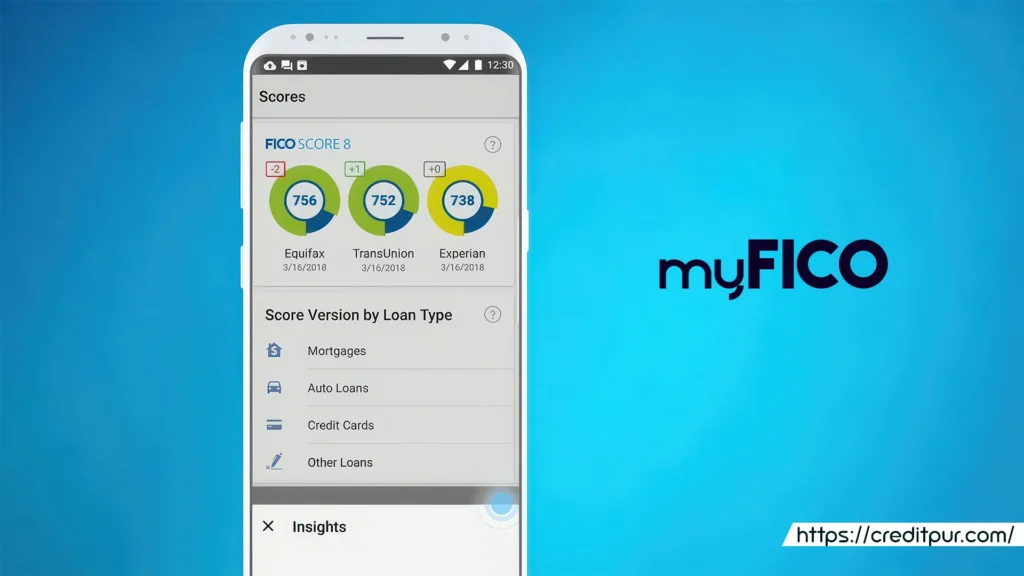

4. myFICO

Overview:

myFICO is the official app from FICO, the company behind the FICO credit score. This app offers in-depth insights into your FICO score, along with detailed analysis and personalized tips for improvement. While it is a paid service, the depth of information provided makes it a worthwhile investment for those serious about understanding their credit.

Key Features:

- FICO Score Access: Provides your FICO score along with a detailed breakdown of the factors affecting it.

- Credit Monitoring: Receive regular updates and alerts about changes to your credit report.

- Educational Resources: In-depth articles and videos explaining credit scoring and how to improve your score.

- Personalized Recommendations: Tailored advice based on your unique credit profile.

- Credit Simulator: Helps you forecast the impact of financial decisions on your FICO score.

Pros:

- Comprehensive analysis directly from FICO.

- Detailed educational content.

- Proactive monitoring and personalized recommendations.

Cons:

- Requires a subscription fee.

- May offer more information than needed for casual users.

Who Should Use It?

myFICO is perfect for users who are serious about their credit health and want the most detailed, FICO-specific information available. If you’re looking to dig deep into your credit report and understand every detail of your FICO score, myFICO provides an unmatched level of insight.

Learn More:

Visit myFICO Official Website

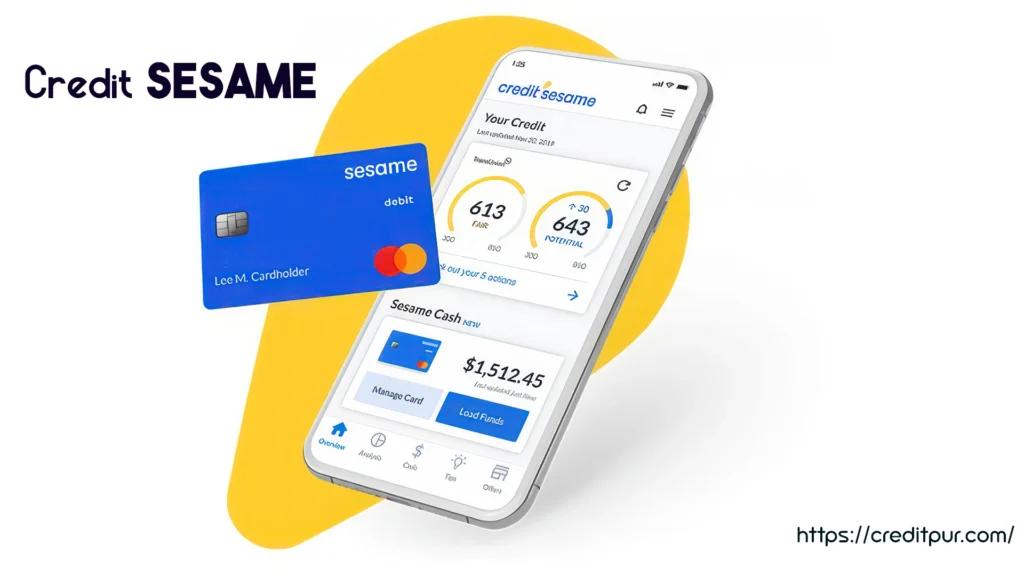

5. Credit Sesame

Overview:

Credit Sesame offers a balanced blend of credit monitoring and financial advice, all for free. It provides access to your credit score along with personalized recommendations on how to improve it. With a focus on user empowerment, Credit Sesame is designed to help you make informed decisions about your financial future.

Key Features:

- Free Credit Score: Get a free credit score updated regularly.

- Identity Protection: Tools to help safeguard your identity and detect potential fraud.

- Personalized Recommendations: Insights tailored to your credit profile to help you make better financial decisions.

- Loan and Credit Card Offers: Curated financial product recommendations based on your credit standing.

- User-Friendly Interface: Simple layout that makes complex financial data easy to understand.

Pros:

- Completely free with a range of useful features.

- Offers identity protection and fraud alerts.

- Provides actionable insights to improve your credit.

Cons:

- Limited to certain features compared to more in-depth paid services.

- The interface, while simple, may not provide all the advanced tools some power users desire.

Who Should Use It?

Credit Sesame is ideal for those who want free access to credit monitoring with the added bonus of personalized financial advice. If you’re looking for an app that combines credit score tracking with identity protection and tailored recommendations, Credit Sesame is a great choice.

Learn More:

Visit Credit Sesame Official Website

6. WalletHub

Overview:

WalletHub distinguishes itself with its real-time credit monitoring capabilities and comprehensive credit analysis tools. Not only does it provide your credit score for free, but it also offers detailed insights into your credit report, along with educational resources to help you boost your financial health.

Key Features:

- Free Credit Score: Instant access to your credit score along with detailed reports.

- Real-Time Monitoring: Continuous updates and alerts on any changes to your credit report.

- Credit Analysis: In-depth breakdowns of the factors influencing your credit score.

- Personalized Tips: Practical advice to help you improve and maintain a healthy credit score.

- User Community: Access to forums and articles where users share their financial experiences and tips.

Pros:

- Real-time monitoring ensures you’re always up-to-date.

- Comprehensive analysis helps you understand your credit in detail.

- Community support and extensive educational resources.

Cons:

- Some features may require linking multiple financial accounts.

- The user interface might be a bit overwhelming for beginners.

Who Should Use It?

WalletHub is well-suited for individuals who desire real-time insights and detailed breakdowns of their credit reports. If you’re proactive about your financial health and appreciate having a community and comprehensive analysis at your fingertips, WalletHub is an excellent option.

Learn More:

Visit WalletHub Official Website

7. Capital One CreditWise

Overview:

Developed by Capital One, CreditWise is a robust and reliable credit monitoring tool that offers free access to your credit score and detailed credit report insights. Even if you’re not a Capital One customer, CreditWise provides valuable tools to help you stay on top of your credit health.

Key Features:

- Free Credit Score Monitoring: Regular updates of your credit score, with detailed explanations of score changes.

- Credit Report Insights: Detailed analysis of the factors affecting your score.

- Identity Theft Alerts: Proactive alerts if any suspicious activity is detected on your credit report.

- Credit Simulator: Explore hypothetical scenarios to understand how different financial moves could impact your score.

- User-Friendly Dashboard: An intuitive interface that makes it easy to navigate your credit information.

Pros:

- Completely free with no hidden fees.

- Developed by a reputable financial institution.

- Offers robust identity protection features.

Cons:

- Some features may be limited compared to premium apps.

- Only available in the U.S.

Who Should Use It?

CreditWise is an excellent choice for anyone looking for a straightforward, reliable credit monitoring app. Whether you’re planning to make a major financial move or just want to keep tabs on your credit, Capital One CreditWise provides the essential tools you need—all for free.

Learn More:

Visit Capital One CreditWise

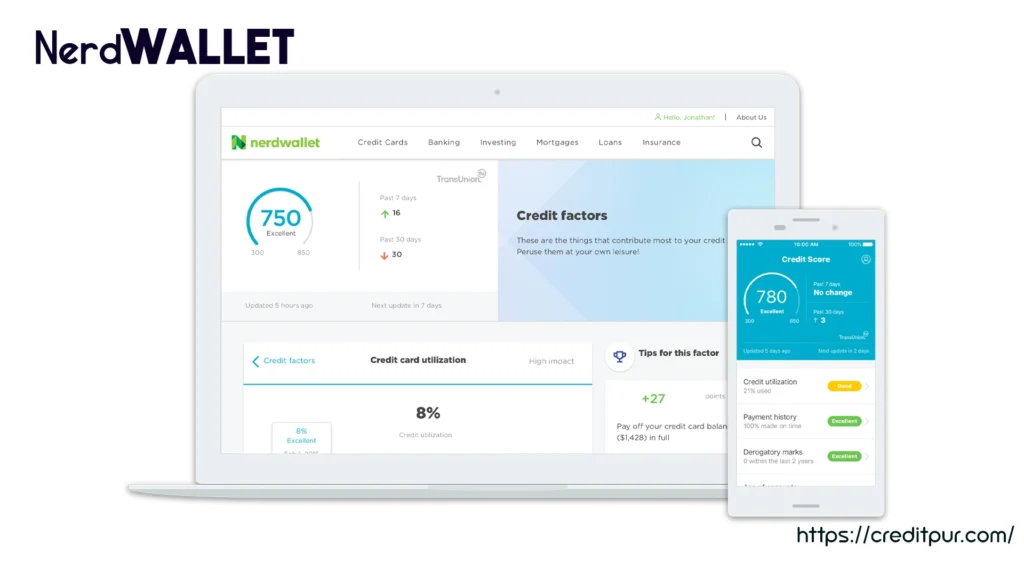

8. NerdWallet

Overview:

NerdWallet is renowned for its comprehensive approach to personal finance, and its credit score monitoring feature is no exception. This app not only provides you with a free credit score but also offers a wealth of resources to help you understand and manage your finances better.

Key Features:

- Free Credit Score: Up-to-date credit score with detailed breakdowns.

- Financial Product Recommendations: Personalized suggestions for credit cards, loans, and other financial products.

- Educational Content: Extensive library of articles, guides, and tips on credit management.

- Budgeting Tools: Integrates credit monitoring with budgeting and expense tracking.

- User-Friendly Design: Simple and engaging interface tailored for ease of use.

Pros:

- Combines credit monitoring with broader financial management.

- Extensive educational resources.

- Personalized recommendations based on your financial behavior.

Cons:

- Some users might find the sheer volume of information overwhelming.

- Occasional promotional content for financial products.

Who Should Use It?

NerdWallet is perfect for individuals who want a holistic view of their financial health. If you’re looking for more than just a credit score—if you want insights into budgeting, loans, and overall financial management—NerdWallet is an excellent resource.

Learn More:

Visit NerdWallet Official Website

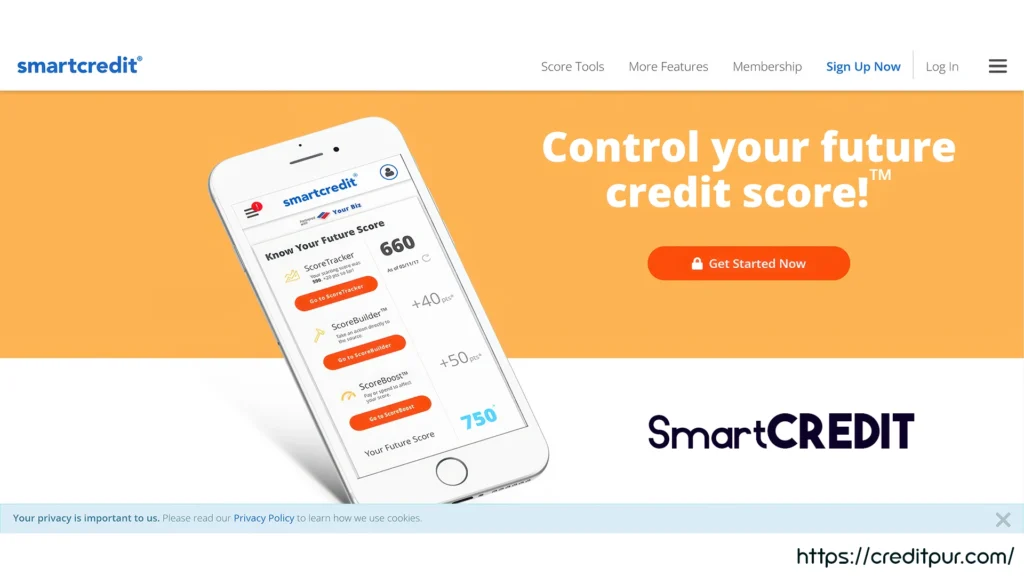

9. SmartCredit

Overview:

SmartCredit is a relatively new player in the market but has quickly gained traction for its comprehensive credit management features. It provides a free credit score, detailed credit report analysis, and actionable insights that help you improve your financial health.

Key Features:

- Free Credit Score: Regularly updated credit score with explanations.

- Detailed Credit Analysis: Breakdown of key factors affecting your credit health.

- Actionable Insights: Personalized recommendations to help boost your score.

- User-Centric Design: Intuitive interface designed for both beginners and experienced users.

- Security Features: Advanced security protocols to ensure your data is protected.

Pros:

- Offers a fresh perspective with innovative features.

- Focuses on actionable insights and practical advice.

- Many different types of people find it easy to use.

Cons:

- As a newer app, it may have fewer user reviews compared to more established platforms.

- Some premium features may require in-app purchases.

Who Should Use It?

SmartCredit is ideal for those who are open to trying innovative financial tools and want actionable insights into improving their credit. If you’re interested in an app that is continuously evolving and adding new features based on user feedback, SmartCredit is worth a try.

Learn More:

While SmartCredit is steadily gaining popularity, you can find more details by exploring user reviews and comparisons on trusted financial blogs and review sites.

10. MoneyLion

Overview:

MoneyLion is not just a credit score app—it’s a comprehensive financial platform that combines credit monitoring with a suite of financial management tools. From credit tracking to personalized financial advice and even investment opportunities, MoneyLion offers a well-rounded approach to your financial health.

Key Features:

- Free Credit Score: Instant access to your credit score with regular updates.

- Credit Monitoring: Alerts and detailed analysis of your credit report.

- Financial Management Tools: Includes budgeting features, investment tracking, and loan recommendations.

- Personalized Advice: Custom financial tips based on your spending habits and credit history.

- Rewards and Benefits: Some users can benefit from cashback rewards and other financial perks.

Pros:

- A comprehensive financial platform beyond just credit monitoring.

- Integrated tools for budgeting, investing, and borrowing.

- User-friendly design with actionable insights.

Cons:

- A membership may be necessary for some advanced functions.

- May be more complex than needed for users solely interested in credit score tracking.

Who Should Use It?

MoneyLion is perfect for individuals who want an all-in-one financial platform. If you’re looking to not only monitor your credit score but also gain insights into overall financial management, budgeting, and even investment opportunities, MoneyLion offers a robust solution.

Learn More:

Visit MoneyLion Official Website

How to Pick the Best App for Your Credit Score

With so many options available, how do you decide which credit score app is right for your needs? Here are some factors to consider:

- Cost: A subscription may be necessary for some premium features, even though many applications provide free services. Think about your spending limit and whether the extra features are worthwhile.

- Data Sources: Different apps may pull data from different credit bureaus. For a comprehensive view, you might want an app that aggregates data from multiple sources.

- User Interface: A clean, intuitive design can make tracking your credit score a much more pleasant experience. Look for apps with a dashboard that’s easy to navigate.

- Security: Since these apps deal with sensitive financial data, robust security measures are a must. Ensure the app you choose uses advanced encryption and other security protocols.

- Additional Features: Some apps offer more than just credit score monitoring. Consider whether you want integrated budgeting tools, financial product recommendations, or educational resources.

Tips for Maintaining a Healthy Credit Score

Even with the best credit score apps at your disposal, maintaining a healthy credit score takes proactive steps. Here are some practical tips to keep your financial health in check:

- Pay the Charges on Time: Your credit score may suffer greatly if you make late payments. To help you remain on track, set up recurring payments or reminders.

- Monitor Your Credit Regularly: Use your chosen credit score app to keep an eye on any changes or discrepancies in your report.

- Maintain a Low Credit Utilization: Try to use no more than 30% of your credit limit. This demonstrates to lenders that you are not taking on more debt than you can handle.

- Diversify Your Credit: It might be advantageous to have a variety of credit forms, such as loans, credit cards, and so on. But only take on debt that you can afford to pay back.

- Dispute Errors Promptly: If you notice any inaccuracies in your credit report, use the dispute tools available on many apps to have them corrected quickly.

- Stay Informed: Use educational resources to understand the factors that affect your credit score and adjust your financial habits accordingly.

Learn More:

Visit: How to Improve Your Credit Score

Comparison Table of Top Credit Score Apps

Below is a quick comparison table summarizing the key features of each app:

| App Name | Cost | Credit Bureaus Covered | Key Features | Ideal For |

|---|---|---|---|---|

| Credit Karma | Free | TransUnion, Equifax | Free score, alerts, personalized recommendations | Comprehensive free monitoring |

| Mint | Free | Varies (with linked accounts) | Budgeting, expense tracking, bill reminders | Holistic financial management |

| Experian | Free/Paid* | Experian | Detailed report, fraud alerts, score simulator | Those focusing on Experian data |

| myFICO | Subscription | FICO | In-depth analysis, educational resources | Users seeking FICO-specific details |

| Credit Sesame | Free | Varies | Identity protection, personalized advice | Free credit monitoring with tips |

| WalletHub | Free | Varies | Real-time monitoring, community insights | Detailed, proactive credit analysis |

| Capital One CreditWise | Free | Varies | Fraud alerts, user-friendly dashboard | Reliable monitoring by a trusted brand |

| NerdWallet | Free | Varies | Financial product recommendations, budgeting tools | Holistic financial insights |

| SmartCredit | Free/Paid* | Varies | Actionable insights, detailed credit analysis | Users open to innovative features |

| MoneyLion | Free/Paid* | Varies | All-in-one platform, rewards, financial advice | Comprehensive financial management |

*Note: Some features may require a premium subscription.

Conclusion

Monitoring your credit score is no longer a cumbersome process reserved for annual reviews or credit reports sent by mail. With the advent of advanced credit score apps, you can now keep a constant watch on your financial health from anywhere, at any time. These apps not only give you real-time access to your credit score but also offer valuable insights, personalized advice, and additional tools to manage your finances more effectively.

From the free and user-friendly Credit Karma and Credit Sesame to the in-depth analysis provided by myFICO and WalletHub, there’s an app out there to meet every need. Whether you’re aiming to improve your credit for a major purchase, secure better loan terms, or simply want to stay informed about your financial status, the right credit score app can be your trusted partner on this journey.

Remember, while these apps are powerful tools, the responsibility for maintaining your financial health ultimately lies with you. Stay proactive, keep informed, and use these resources to make smarter financial decisions every day.

Frequently Asked Questions (FAQs)

- What exactly is a credit score app?

A credit score app is a mobile application that allows you to monitor your credit score, view detailed credit reports, receive alerts about changes, and often provides personalized tips to improve your credit. These apps are designed to make managing your financial health easier and more accessible. - Are credit score apps safe to use?

Yes, reputable credit score apps employ advanced encryption and security protocols to ensure your data is protected. Always choose an app from a trusted provider and review its security features before linking your financial information. - Can I improve my credit score by using these apps?

While the apps themselves don’t directly boost your credit score, they provide the insights and tools you need to understand what’s affecting your score. By following their recommendations—like paying bills on time and reducing credit utilization—you can gradually improve your credit health. - Do I need to pay for a credit score app?

Many credit score apps offer free access to your credit score and basic monitoring tools. However, some apps include premium features that require a subscription. Assess your needs and budget to determine whether a free version suffices or if a paid plan is worth the investment. - How often are credit scores updated on these apps?

Update frequency varies from app to app. Some apps offer real-time monitoring with updates as soon as changes occur, while others update your score on a monthly basis. Check the app’s details to understand its update schedule.

1 thought on “10 Best Credit Score Apps for Monitoring Your Financial Health”